The Chancellor announces changes to Stamp Duty Land Tax.

We all heard the rumours in the press and media that Jeremy Hunt was considering making changes to the current SDLT rates to help boost the Housing Market, and, in his budget yesterday, he finally announced some changes, but not in a way that any of us expected! Rather than announcing any form of reduction or additional reliefs, he instead will abolish Multiple Dwelling Relief saying that the Government felt the relief was being abused by certain purchasers. This is clearly a significant change and will be a blow for many property investors.

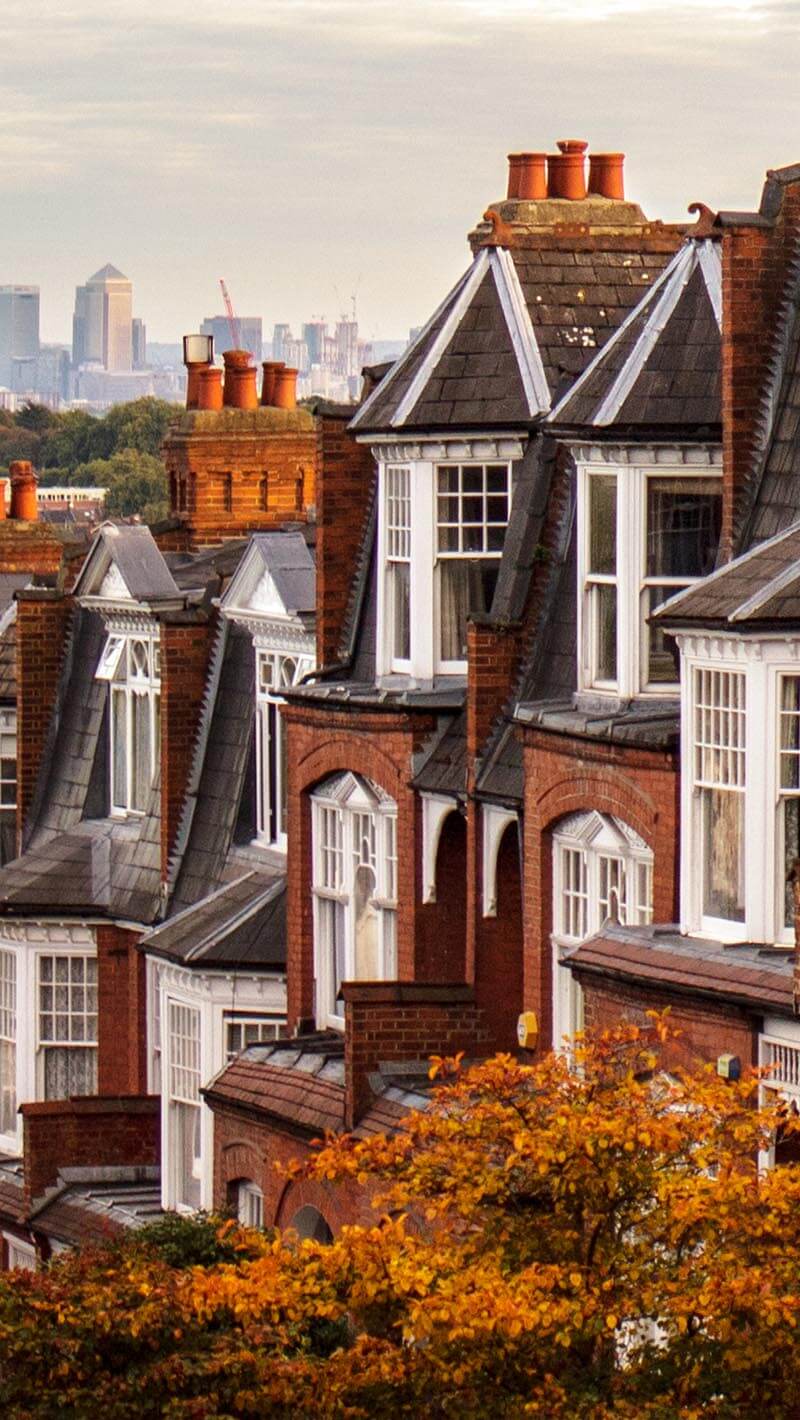

Being such a hot topic, we thought it would be useful to have a reminder of how stamp duty first came about and what rates apply today.

History of Stamp Duty Land Tax

Today, SDLT is a mandatory tax on land transactions involving any estate, interest, right or power in or over land in England and Northern Ireland. However, the concept of stamp duty was first introduced in 1694, during the reign of William III and Mary II, where a tax was levied on all purchase transactions as a method of paying towards the war against France. Stamp duty was originally intended to last only four years (until the end of the war), but the concept has remained and now exists in the form of SDLT.

Stamp duty was initially used on purchase transactions which typically involved documents such as newspapers and advertisements, and other goods such as hats, gloves, and medicine. Stamp duty used to be a fixed amount, but in 1808, stamp duty on transfers of land and shares became a tax on a proportionate value of whatever was being transferred – much like it is today. Over the years the scope of stamp duty was largely reduced, until on 1 December 2003 (under the Finance Act 2003) it was largely abolished and only SDLT remained.

Current SDLT rates

From 23 September 2022, payment of SDLT is triggered on purchases of residential properties over £250,000, and the amount you pay is calculated in increasing portions of the property price. Rates for a single property are outlined below:

| Property or lease premium or transfer value | SDLT Rate |

| Up to £250,000 | Zero |

| The next £675,000 (the portion from £250,001 to £925,000) | 5% |

| The next £575,000 (the portion from £925,001 to £1.5 million) | 10% |

| The remaining amount (the portion above £1.5 million) | 12% |

The amount you pay will also depend on whether any exemptions/reliefs apply or whether a special rate applies:

Multiple Dwellings Relief: In 2011, the government introduced Multiple Dwellings Relief (MDR) to encourage investment in residential property. MDR was available for purchasers of residential property who acquire interests in more than one dwelling in a single or linked transaction. The purpose of MDR was to reduce the rate of SDLT on the purchase of more than one dwelling, so that it was closer to the rate that would apply if the dwellings were purchased separately in a different transaction. As per the new spring budget, from 1 June 2024, MDR will be abolished.

First Time Buyer Relief: If you are a first time buyer, SDLT will only be payable on residential properties over £425,000 (if the property is worth £625,000 or less). 5% SDLT will then be payable on the portion from £425,001 to £625,000. If the purchase price is over £625,000, you cannot claim the relief and the above rates for a single property apply.

Higher Rates for Additional Property: If you acquire an additional property, you may be subject to a higher SDLT payment. You will usually have to pay an additional 3% on top of the standard SDLT rate for second homes. Note that there are exceptions to this if you are replacing your main residence.

Higher Rates for “Non-UK Residents”: From 1 April 2021, a 2% surcharge is applicable to all ‘non-resident transactions’. Therefore, if you are not present in the UK for at least 183 days (6 months) during the 12 months before your purchase you may be considered as “non UK resident’ for the purposes of SDLT.

Higher Rates for Corporate Bodies: SDLT is charged at 15% on residential properties costing more than £500,000 bought by certain corporate bodies or ‘non-natural persons’ eg a company or partnership.

Written by Mark Scott (Partner) and Victoria Long (Trainee Solicitor) in the Property Conveyancing Team of RWK Goodman, London office.

More property conveyancing articles from RWK Goodman:

View more articles related to Property Conveyancing