Coronavirus – the impact on financial health

This blog aims to look at the impact that coronavirus may have on the economy, what steps people may take to protect themselves and what this may mean for the insolvency sector going forward.

We are already seeing the impact on the stock market (black Monday) and disruption to travel; however, for many people, the impact on their day-to-day lives will stretch far beyond their health, ability to go on holiday and choice of toilet roll (if you are lucky to find any).

It will have an impact both on people’s livelihoods and the global economy as a whole. This will see an increase of activity within the insolvency sector as people and businesses struggle with cash flow and to pay debts.

Why is there such an impact – isn’t it just the flu?

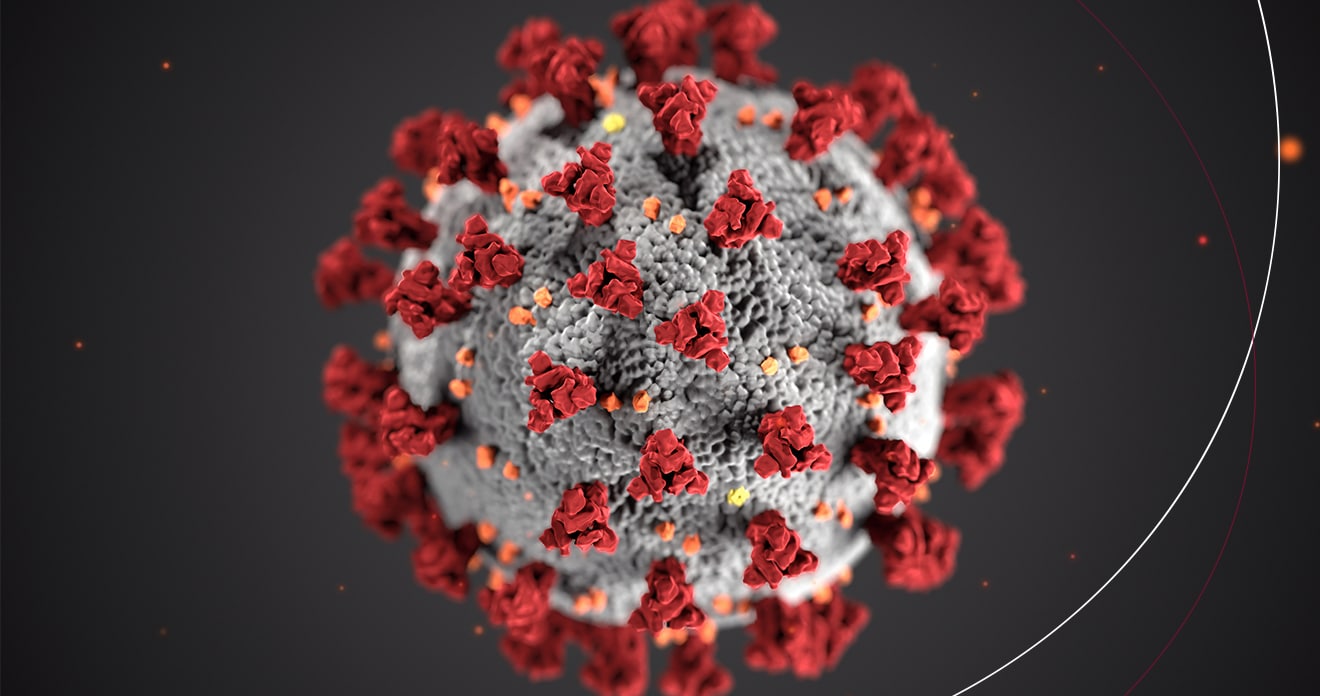

While many of the symptoms between the common flu and COVID-19 are similar, it is the rate at which it can spread and the lack of research/knowledge into it which has resulted in governments across the world taking steps to contain and delay.

By containing and delaying the spread, governments are hoping that it will assist healthcare services with resources. It also gives us time to complete research which will hopefully provide effective forms of treatment.

Unfortunately, self-isolation and quarantine will not be good for the economy, which is undoubtedly reflected within the UK Government’s current response to tackling COVID-19.

Why will it affect my business, work or trade?

For many businesses, the rate at which the virus can spread will mean that a number of employees will be out of action at any given time. It will be more difficult to conduct business as the country takes steps to self-isolate and quarantine. This may cause cash flow problems and will mean that companies and individuals may not be in a position to meet debts as they fall due.

Further, for companies within the travel, hospitality and entertainment industries, the potential ban on public events and travel will affect their ability to trade. For example, Flybe entered into administration on 5 March 2020 due to the number of bookings cancelled.

The social and healthcare industries will also be heavily affected by their very nature of working with elderly and vulnerable people.

We predict many more companies will need to consider redundancies, restructuring and potential winding-down within the near future.

Individuals may struggle to pay bills as their pay drops due to self-isolation and quarantine. This will have a longer-lasting effect for those who are care providers for the vulnerable and/or work within the health and social care industries as well as the self-employed.

Again, we expect to see an increase in bankruptcies and company insolvencies as a result.

What this means for the insolvency sector

People working within the insolvency sector should be prepared to receive an influx of approaches for individuals and business in financial difficulty. They will need to be prepared to advise on a wide range of topics including dispute resolution, employment, real estate and restructuring.

There will be added complications too, especially within cross-border disputes and issues concerning service of court documents while governments advise to limit travel and offices close.

Today (13 March 2020), HMCTS have released advice on its own planning and preparation in relation to issues concerning COVID-19, which includes advice on coming to court, video hearings and how they intend to update firms and parties during the outbreak.

So what can we do?

DO NOT PANIC.

The Government and Bank of England have launched a number of measures to help people and businesses through this difficult period, which includes an emergency cut in interest rates, deferred mortgage payments and loan repayments (from certain banks), suspending business rates, extending sick pay and a £30bn investment into the NHS and business.

Similar to the current stance taken by the Government, the best way to protect yourself financially is to step back, assess your situation and take precautions rather than try to fight what might feel like the inevitable. If you are a vulnerable person, carer of a vulnerable person or a business within a heavily affected industry, you should assess your financial health and potentially seek advice from a lawyer and insolvency practitioner about whether you are in a position to meet long-term or short-term debts.

If you are already facing debt recovery/insolvency action, there may be steps that we can take to assist you. This may include a range of proposals including administrations, restructuring or simply reaching a deal with your creditors.

At RWK Goodman, we are able to provide advice to Insolvency Practitioners, businesses and individuals on a range of topics including dispute resolution, restructuring, debt recovery, employment and private wealth. We also have dedicated teams within retail, social care, leisure and hospitality, charities and TMT.