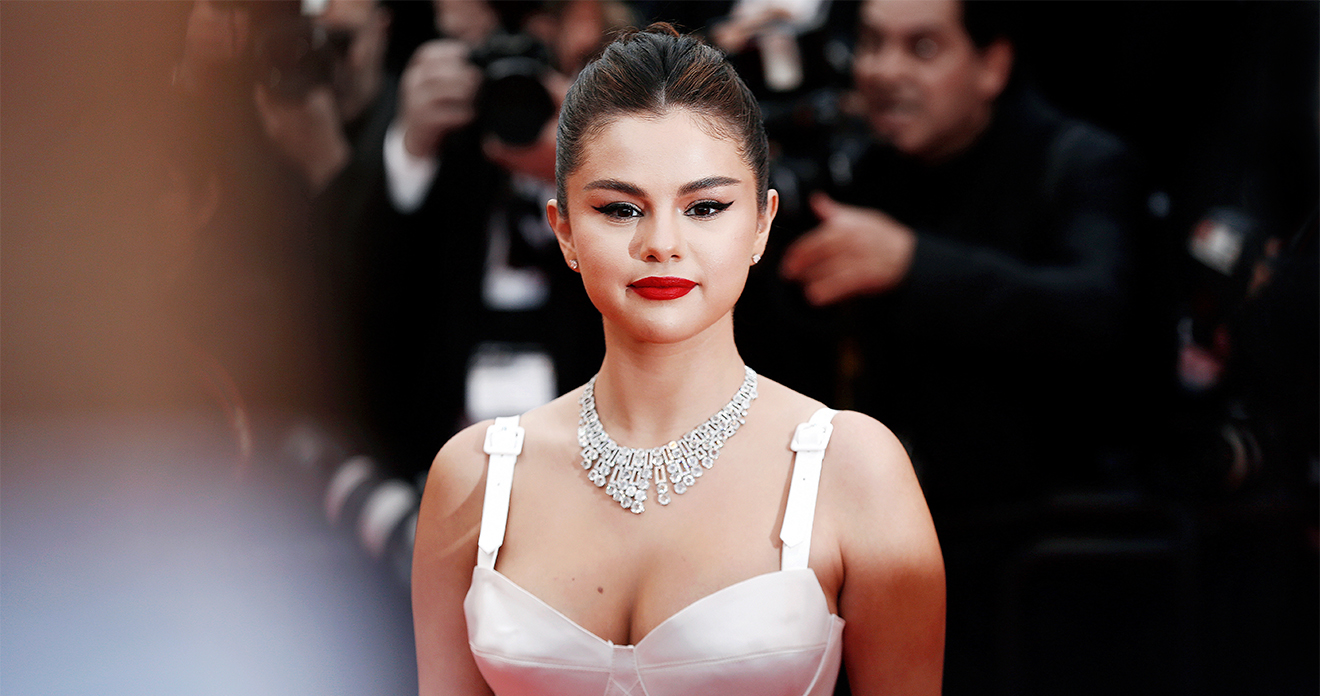

Love you like a Prenup: Why Selena Gomez’s Prenup is a valuable lesson to us all

Prenuptial agreements are considered smart planning for modern relationships.

Renowned pop star, Selena Gomez, has made the conscious decision that come rain or shine, she has a watertight prenuptial agreement in place ahead of her marriage to Benny Blanco. While both are successful and well known figures in the entertainment industry, they have taken steps to protect the wealth and assets they each accumulated prior to their marriage, in the unfortunate event of a divorce.

It’s commonly believed that prenuptial agreements are primarily for protecting personal wealth, but they also play a vital role in safeguarding business interests and family inheritance. In Selena’s case, she has ringfenced the following:

- Her billion dollar company, Rare Beauty, founded in 2020 which is now worth approximately $2.7 billion.

- Her music catalogue worth approximately $400 million.

- Her real estate portfolio worth approximately $35 million, which include properties both in America and elsewhere.

While it’s not publicly known what Benny Blanco has secured in the agreement, it’s reasonable to assume that his $50 million net worth, acquired through a successful career as a songwriter, producer and musician, is protected.

Given the clear disparity in net worth between the two, the importance of a prenuptial agreement is evident. It not only protects Selena’s substantial assets but also ensures that Benny’s financial interests are acknowledged and safeguarded should the marriage come to an end.

What current research says

Recent research by Handelsbanken Wealth & Asset Management highlighted the following “nine-in-ten (89%) UK couples in marriages or civil partnerships do not have a prenup in place. Our data shows that prenups are rising in popularity among younger couples: the overwhelming majority (99%) of over-55s did not have a prenup in place, but this fell to 60% for those under 34 years old”. Those that did have a prenuptial agreement, did so on the basis that it gave them “peace of mind around financial matters”. With over 40% of marriages ending in divorce, taking precautionary steps to protect one’s finances through a prenuptial agreement is no longer seen as extravagant, rather, it is a prudent way to future proof, manage risk and asset protect.

What can prenuptial agreements address

Prenuptial agreements go far beyond simply safeguarding money in the bank, they can encompass a broad range of assets and liabilities. While savings, pensions and property are commonly included, there are many other assets that can be addressed in the agreement for example, airmiles and cryptocurrencies. This may also often include investments and inheritances, allowing one partner to maintain control over future capital. Shares in companies and other business interests can be protected too. Prenuptial agreements can also protect against liabilities, shielding you from legal responsibility for your partner’s debts.

The key take away

Every prenuptial agreement should be tailored to the couple’s unique circumstances. There is no one size fits all solution, it’s about understanding your assets, liabilities and long term goals and planning accordingly. Whilst in the above case, the prenuptial agreement is protecting millions, they are no longer being entered into for the ultra-wealthy. Many couples are now entering marriages with significant assets accrued prior and seek to ensure these are protected in the event of divorce.

For more information please contact:

Learn more about our expertise in this area:

More articles from RWK Goodman:

View more articles related to Family, Pre and Post Nuptial Agreements and Separation & Divorce